Filing for income tax is not the most exciting activity a person can do. However, it’s a critical part of your family and personal financial planning. You have to learn good habits in meeting your tax obligations while minimizing your tax liability. But how exactly do you do this?

https://pxhere.com/en/photo/782062

https://pxhere.com/en/photo/782062

Learn the Basic Tax Terms

Before you start managing your tax income, you must first make sure that you fully comprehend the most important tax terms which are as follows:

-

Gross Income

Gross income is your total income for the year. It includes your salary, house property, capital gains, business, and other sources. From this gross income, you can subtract your exemptions and deductions. Then, you can calculate your real taxable income.

-

Exemption Limit

While it’s true that it’s a citizen’s responsibility to pay his taxes regularly, not everyone is required to do it. You only pay taxes when your income is taxable. Learning about the basic exemption limit will help you determine if your income is under or above the taxable income. If your income is below the exemption limit, you don’t need to pay tax.

-

Deductions

Aside from basic exemption limits, you must also know about deductions. Deductions are tax benefits that you can avail of to reduce your taxable income. These will be subtracted from the gross income after you’ve determined your taxable income.

-

Exemptions

These are monetary exemptions that will help reduce your tax. They might reduce your tax rate, give tax relief, or allow you to apply tax to certain portions of an income only.

-

Slab Rates

Slab rates refer to the different levels of income in which you determine your taxability. It means that all taxpayers are divided into different groups according to their income. These groups are called tax slabs. When your income goes up or goes down, you also change your tax slab. In this case, you also change your slab rate.

Prepare Before the Tax Dates

You must know when you’re due to submit your income tax filings. Mark this in your calendar so that you don’t forget. When you’re rushing to process your income tax filing, you’re more likely to make mistakes. It’s advisable that you start preparing weeks before the tax date. Here are the different dates and deadlines that you should verify with a tax authority:

-

Tax period

-

Deadline for filing your income tax and tax returns

-

Deadline for extension

-

Deadline for paying tax and extra tax

-

Deadline for paying corrections

You might be able to find all these tax deadlines on the Internal Revenue Service website or its equivalent in your country.

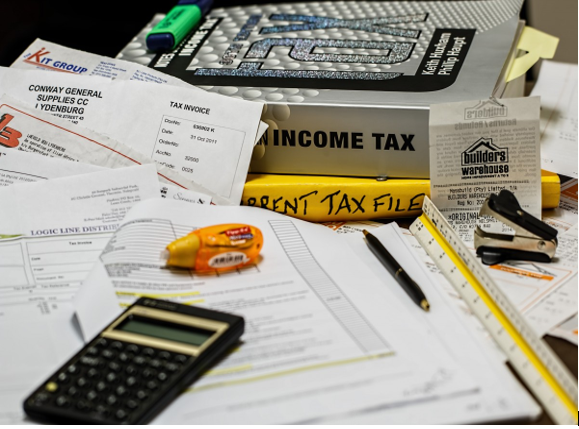

File Items Related to Your Income Tax

To not make a mess when the deadline is near, buy a folder or dedicate a drawer where you can safely put paperwork related to your income tax. This will eliminate the possibility of missing details.

Be as organized as you can. Print copies of your tax files and deductions even when you’ve done them online. Also, when you receive statements or receipts necessary in the filing, keep them in your folder or drawer.

Understand Income Tax Rules

The more you know about your jurisdiction’s income tax laws, the more you’ll be able to quicken the process and avoid any penalties. If it’s hard for you to understand the laws by yourself, you might want to enroll yourself in an income tax seminar. This is especially important if you are a business owner. Sometimes, there are rules that are not available for individuals but are available for business owners.

Knowing the right steps to manage your income tax helps in reducing the stress that comes during the tax period and in avoiding wrong payments and penalties. If you’ve mastered income tax laws, you might even be able to pay less tax and increase your income.